Key learnings from the Seminar(8页)PPT.pdf

已下载:0 次 是否免费: 否 上传时间:2012-03-05

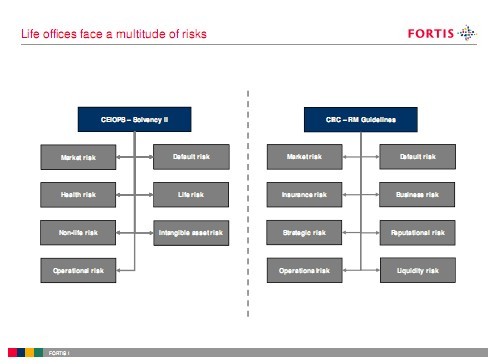

Life offices face a multitude of risks

CEIOPS – Solvency II

Market risk Default risk

CIRC – RM Guidelines

Market risk Default risk

FORTIS I

Health risk Life risk

Non-life risk Intangible asset risk

Operational risk

Insurance risk Business risk

Strategic risk Reputational risk

Operational risk Liquidity riskEvolution of ERM

FORTIS IIAA Practice Note – a useful reference

Governance and an ERM framework

Risk management policy

Risk tolerance statement

Risk responsiveness and feedback loop

Contents

FORTIS I

Own risk and solvency assessment (ORSA)

Economic and supervisory capital

Continuity analysis

Role of supervision in risk management

Key features of ERM from IAIS

FORTIS IExample of a governance structure

Board of Directors

(Chairman)

RM Committee

(C’tee Chair)

Overall RM strategy and policy

Set risk appetite

Ensuring suitable RM and control framework

Effectiveness of the Insurer’s Risk Management

Framework

Compliance with supervisory requirements

Establishment of a suitably independent risk

FORTIS I

Sub-Committees

Senior Management

(incl. CRO)

RM Function

(CRO)

Establishment of a suitably independent risk

function with the authority, standing and resources

to effectively execute its mandate

Monitoring the adequacy of corporate insurance

covers.

Day to day operation of risk management

Implementing RM framework

Developing and maintaining RM tools and data

Fostering an RM culture: language / behaviour

立即下载

立即下载 立即收藏

立即收藏