Supporting Management Decisions using Economic Capital(6页)PPT.pdf

已下载:0 次 是否免费: 否 上传时间:2012-02-20

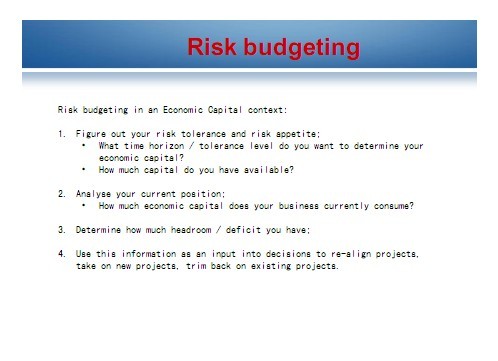

Risk budgeting

Risk budgeting in an Economic Capital context:

1. Figure out your risk tolerance and risk appetite;

What time horizon / tolerance level do you want to determine your

economic capital?

How much capital do you have available?

2. Analyse your current position;

How much economic capital does your business currently consume?

3. Determine how much headroom / deficit you have;

4. Use this information as an input into decisions to re-align projects,

take on new projects, trim back on existing projects.

The right mix

An initiative requires CNY 20bn of additional market risk capital.

How desirable is it?

Assume only two types of capital, life risk capital and market risk capital,

with correlation of 0.25

Company A has CNY 100bn of market risk capital;

Company B has CNY 100bn of life risk capital.

For Company A, the resulting capital is

CNY 20bn + CNY 100 bn = CNY 120 bn

For Company B, the resulting capital is

(1002 + 202 + 0.25 x 100 x 20)1/2 = CNY 104 bn

Company B is able to take this risk more economically.

Project appraisal

IRR is a classic way of project appraisal.

We can incorporate the cost of holding economic capital into this

analysis

The initial level of economic capital is important, but so is the run-

off.

Allowing for the cost of economic capital is a way of adjusting for risks.

立即下载

立即下载 立即收藏

立即收藏