Joint Regional Seminars(143页)PPT.rar

已下载:0 次 是否免费: 否 上传时间:2012-02-03

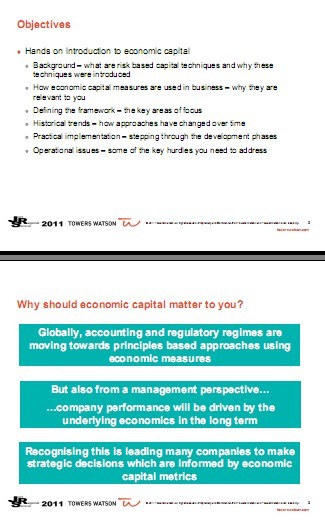

Objectives

Hands on introduction to economic capital

Background – what are risk based capital techniques and why these

techniques were introduced

How economic capital measures are used in business – why they are

relevant to you

Defining the framework – the key areas of focus

Historical trends – how approaches have changed over time

Practical implementation – stepping through the development phases

Operational issues – some of the key hurdles you need to address

Why should economic capital matter to you?

Globally, accounting and regulatory regimes are

moving towards principles based approaches using

economic measures

But also from a management perspective…

…company performance will be driven by the

underlying economics in the long term

Recognising this is leading many companies to make

strategic decisions which are informed by economic

capital metrics

Objectives

Introducing and defining capital

Different approaches used for different purposes

What are risk based capital techniques

Why these techniques have been introduced

What is capital?

Capital = assets – liabilities

Required capital = capital required to

support the business written

Regulatory required capital

Rating agency required capital

Internal required capital

Available capital = capital available

to support the business written

ssets

Available

capital

Required

capital

Free

capital

Technical

provisions

Why do companies hold capital?

Holding capital to support the business is a regulatory requirement…

…and it’s also essential for managing the business

Risk Capital

Risk exposure determines

capital needs

Required capital is a function

of the tail of the risk

distribution

立即下载

立即下载 立即收藏

立即收藏